Ethereum Price Prediction: Technical Consolidation Meets Strong Institutional Fundamentals

#ETH

- Technical Positioning: ETH trades below key moving average but shows signs of consolidation near support levels

- Institutional Momentum: Significant ETH accumulation by major firms provides fundamental support

- Sentiment Balance: Positive long-term adoption narrative contrasts with short-term technical challenges

ETH Price Prediction

ETH Technical Analysis: Consolidation Phase Below Key Moving Average

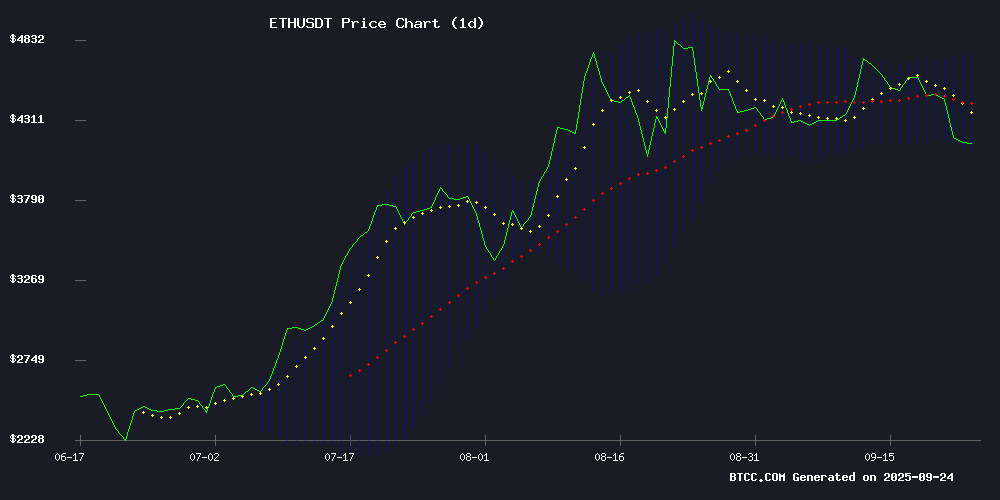

ETH is currently trading at $4,178.81, positioned below the 20-day moving average of $4,421.70, indicating short-term bearish pressure. The MACD reading of -43.86 remains in negative territory, though the narrowing gap between the MACD line and signal line suggests weakening downward momentum. Price action is hovering NEAR the lower Bollinger Band at $4,101.58, which may serve as immediate support.

According to BTCC financial analyst James, 'The technical setup shows ETH is in a consolidation phase. The key resistance sits at the 20-day MA around $4,422, while sustained trading above $4,100 could establish a foundation for upward movement. Traders should watch for MACD crossover signals for directional clarity.'

Mixed Sentiment as Institutional Adoption Grows Amid Price Pressure

Recent developments present a complex picture for Ethereum. Positive institutional news includes FG Nexus reaching a 50,000 ETH treasury milestone and BitMine Technologies accumulating 2% of Ethereum's supply in a $10.1 billion strategic move. However, price action remains constrained with ethereum struggling below key resistance levels.

BTCC financial analyst James notes, 'The fundamental backdrop is strengthening with Wall Street blockchain adoption narratives and significant institutional accumulation. While short-term technicals show pressure, the growing institutional interest and Vitalik Buterin's advocacy for open systems provide solid long-term foundations. Market sentiment appears cautiously optimistic despite current price challenges.'

Factors Influencing ETH's Price

Ethereum Poised to Dominate Wall Street Blockchain Adoption, Says Tom Lee

Fundstrat co-founder Tom Lee has positioned Ethereum as the leading blockchain for institutional adoption, citing its neutrality and growing financial infrastructure. At Korea Blockchain Week 2025, Lee emphasized Ethereum's unique appeal to Wall Street due to its lack of preferential treatment toward any single entity—a critical factor for large-scale financial players.

Institutional momentum is accelerating, with 86% of investors planning digital asset allocations according to a Coinbase/EY survey. Spot ETH ETFs recorded historic inflows in July 2025, while the TRUMP administration's pro-crypto stance further bolsters Ethereum's regulatory positioning. Lee projects ETH could reach $10,000-$12,000 by year-end.

BitMine Immersion Technologies, where Lee serves as chairman, now holds 2% of Ethereum's total supply—a tangible bet on the network's dominance. The move underscores institutional confidence in ETH's role in tokenization and stablecoin growth.

Ethereum Founder Vitalik Buterin Advocates for Open Systems to Safeguard Democracy and Privacy

Ethereum co-founder Vitalik Buterin has expanded his discourse beyond cryptocurrency, emphasizing the dangers of closed, centralized systems in critical sectors. In a recent blog post, Buterin warned that reliance on opaque infrastructures in healthcare, finance, and governance fosters monopolies, power abuses, and erodes public trust. "The default path," he wrote, "leads to corporations and governments constructing self-serving systems rather than societal benefits."

Buterin argues that open-source, verifiable infrastructure is essential for accountability. Transparent systems empower societies to shape technology, mitigating exploitation risks. Closed systems, while superficially efficient, often conceal vulnerabilities and inefficiencies.

The COVID-19 vaccine rollout exemplified these flaws. Proprietary production and opaque communication undermined trust, while initiatives like PopVax demonstrated how open-source approaches reduce costs and enhance credibility. In finance, Buterin contrasts traditional services with blockchain networks, highlighting the latter's potential for transparency and decentralization.

Vitalik Buterin Advocates for Open-Source, Verifiable Digital Infrastructure

Ethereum co-founder Vitalik Buterin has issued a compelling call for open-source and verifiable infrastructure in critical sectors such as healthcare, finance, and governance. Centralized systems, he warns, erode trust and security—cornerstones of digital innovation. "The civilizations that gained the most from new waves of technology are not the ones who consumed it but the ones who produced it," Buterin wrote, underscoring the imperative of transparency.

Buterin's critique targets proprietary health tech for fostering data monopolies and surveillance risks, while praising initiatives like PopVax for leveraging open-source models to cut costs and build public trust. His argument hinges on verifiability as a bulwark against exploitation and monopolization in an increasingly digitized world.

Ethereum Struggles Below Key Resistance as Bears Threaten Deeper Correction

Ethereum's price action has turned bearish after failing to sustain above $4,500, with the cryptocurrency now trading below critical moving averages. The breakdown below $4,220 confirms weakening momentum, as ETH tests the psychological $4,000 support level.

Technical indicators paint a concerning picture—the hourly MACD shows increasing bearish divergence while the RSI languishes below 50. A decisive close beneath $4,000 could trigger cascading liquidations toward the $3,560-$3,750 demand zone, representing a potential 15% decline from current levels.

Market structure reveals layered resistance between $4,280-$4,370, marked by a descending trendline on hourly charts. Three failed attempts to breach $4,100 earlier this month underscore the persistent selling pressure. Yet Ethereum's long-term prospects remain intact, with some analysts eyeing an $8,400 target upon eventual breakout.

FG Nexus Reaches 50,000 ETH Treasury Milestone as Stock Rises

FG Nexus has crossed a significant threshold by amassing 50,000 Ethereum (ETH) in its corporate treasury, now valued at $210.1 million. The accumulation follows a strategic pivot announced in August, with the firm disclosing its holdings on Tuesday. The revelation spurred a 4.5% surge in pre-market trading for its stock (FGNX).

The company's average purchase price stands at approximately $3,860 per ETH. While FG Nexus now holds a notable position in the corporate Ethereum treasury race, it still trails Bitmine Immersion Technologies (BMNR), which boasts over 2.4 million ETH—about 2% of the circulating supply. FG Nexus aims for a more aggressive 10% stake. Last week alone, it added 285 ETH to its reserves, capitalizing on Ethereum's $4,200 market price at the time of purchase.

Despite Tuesday's gains, FGNX shares remain down 68% year-to-date and 71% over the past 12 months. Retail sentiment, however, appears to be shifting. BMNR, led by Tom Lee, also saw pre-market gains of 2%, maintaining interest with its Ethereum accumulation strategy. The competition for ETH dominance among publicly traded firms shows no signs of abating.

Grayscale Ethereum Trusts Transition to NYSE Arca's Generic Listing Framework

Grayscale's Ethereum investment products, including the Grayscale Ethereum Trust and Ethereum Mini Trust, have migrated to NYSE Arca's generic listing standards. This strategic shift eliminates the need for individual SEC approval orders, creating a streamlined pathway for future Ethereum ETF operations.

The SEC approved NYSE Arca's Rule 8.201-E on September 17, 2025, with the exchange filing the proposed change two days later. This regulatory evolution marks a significant milestone in cryptocurrency market accessibility, mirroring the maturation seen previously with Bitcoin investment vehicles.

Market participants anticipate this development will accelerate the launch of new Ethereum-based products while reducing administrative burdens. The generic framework represents a vote of confidence in Ethereum's market infrastructure, potentially signaling broader institutional acceptance of the second-largest cryptocurrency.

FG Nexus Preferred Shares Dip Slightly Despite Ethereum Treasury Milestone

FG Nexus Inc. saw its preferred shares (FGNXP) decline 0.53% to $17.89 on September 22, 2025, despite announcing a significant accumulation of 50,000 ETH valued at approximately $210 million. The company's average acquisition cost of $3,860 per ETH positions it favorably against Ethereum's current market price of $4,200, reflecting substantial unrealized gains.

The minor stock movement suggests profit-taking or short-term market adjustments rather than skepticism about the firm's digital asset strategy. FG Nexus now ranks among the top corporate holders of Ethereum, with plans to stake its holdings for passive yield generation. Light trading volume accompanied the share price dip, indicating muted reaction to the treasury milestone.

BitMine Technologies Amasses 2% of Ethereum Supply in $10.1 Billion Strategic Accumulation

BitMine Technologies has emerged as the world's largest corporate holder of Ethereum, disclosing ownership of 2.4 million ETH worth $10.1 billion at current prices. The crypto treasury firm acquired its position at an average cost basis of $4,500 per coin—a 7.25% premium to today's $4,200 market price—betting on long-term appreciation despite the unrealized loss.

The company recently raised $365 million through a secondary share offering to expand its ETH reserves, following aggressive accumulation earlier this month that included a $200 million purchase of 46,255 coins. Strategic ETH Reserve data confirms no other corporate treasury holds comparable exposure, with second-place SharpLink Gaming controlling just 838,150 ETH.

BitMine's total assets under management now stand at $11.4 billion when including cash, equity, and digital assets. The move reflects growing institutional conviction in Ethereum's value proposition, even as competitors like Strategy maintain larger overall crypto treasuries through diversified holdings.

Ethereum Holds $4,000 Support Amid Market Turbulence

Ethereum's price hovers near $4,185, marking a 4.2% decline over the past 24 hours as broader market selloffs trigger $1.7 billion in altcoin liquidations. The second-largest cryptocurrency has struggled to breach the $4,500 resistance level despite strong support above $4,200.

Exchange outflows tell a different story. Over 420,000 ETH left trading platforms this week, signaling accumulation by long-term holders even as short-term traders face liquidations. Technical charts show Ethereum trapped between $4,450 support and $4,510 resistance, with analysts eyeing $3,700-$3,800 as the next potential downside target.

Macroeconomic headwinds compound the pressure. Persistent outflows from U.S. crypto ETFs and inflationary concerns have dampened sentiment. The specter of Federal Reserve rate hikes looms over risk assets, creating what one trader called 'a perfect storm of caution.'

How High Will ETH Price Go?

Based on current technical and fundamental analysis, ETH shows potential for recovery toward the $4,400-$4,700 range in the medium term, contingent on breaking key resistance levels.

| Scenario | Price Target | Key Conditions |

|---|---|---|

| Bullish Breakout | $4,700 - $5,000 | MACD turns positive, sustained above 20-day MA |

| Base Case | $4,400 - $4,600 | Holds $4,100 support, institutional accumulation continues |

| Bearish Scenario | $3,800 - $4,000 | Breaks below $4,100 support, MACD deterioration |

James from BTCC emphasizes that 'The $4,100 support level is critical. Successful defense of this level, combined with growing institutional adoption, could propel ETH toward $4,500 once technical resistance at $4,422 is conquered.'